Challenge: Streamline the Commercial Loan Documentation Process

Washington Trust Bank wanted to streamline the exhaustive and complicated process of printing commercial loan documentation. The old process was difficult to understand, particularly for new users. The process included accessing screens of questions that didn’t apply to every loan request. It was unclear what was needed for the loan that was in progress. As a result, the program wasn’t used as intended, and there was little consistency in where documentation was input. When the application was sent to the loan servicing center, underwriters needed to comb through the application to find pertinent information.

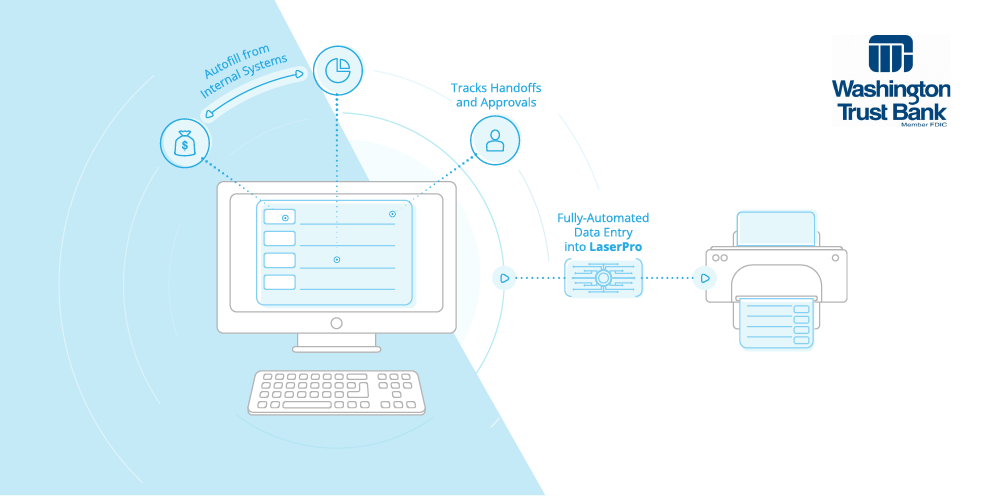

The bank required a smart application to improve the efficiency of the process. The ideal system would automate the labor-intensive and error-prone loan application process by pulling data from two different internal databases while ensuring all the fields in the application were transferable to LaserPro – a standard program for printing loan documents.

A small development team at the bank started to build the new application to improve upon their 15-year-old legacy system. Washington Trust wanted to cash in on a sweet spot in the loan market that wouldn’t last long. Various project demands proved difficult, and the deadline for completion was fast approaching. They decided to bring IntelliTect on to provide technical leadership and improve efficiency and performance.

Having a local partner with the knowledge, responsiveness, and willingness to help execute our vision is huge for Washington Trust Bank. This partnership with IntelliTect has sparked a culture of continuous improvement and set the stage for further innovation.

Cliff Conklin, Director of Development, Washington Trust Bank

Products & Services Used:

- Functional Test Automation

- Continuous Integration

Services Continued:

- Angular 4

- C#

Industries:

- Finance/Insurance

Solution: Developing Three Smart Applications

The IntelliTect developers integrated with the bank’s development team and were quickly brought up to speed on the bank-specific processes and required technical solutions. The IntelliTect team quickly identified gaps in the project and obtained the resources needed to get the program on track to meet tight deadlines while developing a bullet-proof code base.

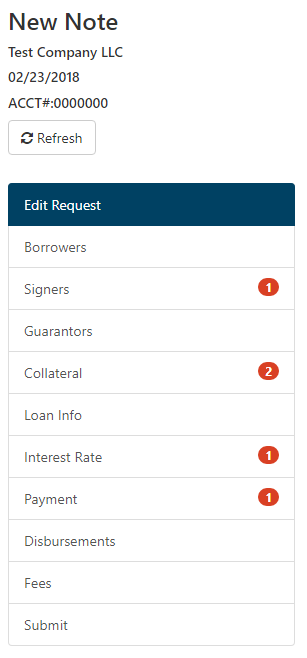

The new system required three separate lines of business applications: New Note, Change in Terms, and Renewal. The team completely overhauled the existing code base of the new Change in Terms application, then they used this new application as a starting point to develop New Note and Renewals.

The team initiated a pilot program for loan processors to test the new Change in Terms application so that they could use the system as it was being finalized. This program provided needed feedback to improve the overall experience of the user and the customer. Several users of the program sent emails stating that it was “looking great and much more user-friendly than (their) current application.”

As a result, the integrated team created a smart app with the following abilities:

- Simplified, easy-to-use workflow that takes the guesswork out of the process

- Queue management with intuitive experience showing all outstanding items at-a-glance including tracking hand-offs and approvals

- Fully automated data entry into LaserPro

- Follows strict business processes with complex workflows

- Upload multiple files of different document types

- Track appraisal values of collateral, insurance, real estate info and other items that were previously entered manually in LaserPro

- Captures signers, guarantee type, and the ability to link collateral

- Captures all specifications for the loan type including note types and purpose codes

- Deals with a range of Rate Indexes, iBasis terms, and LIBOR amounts

“Having a local partner with the knowledge, responsiveness, and willingness to help execute our vision is huge for Washington Trust Bank. This partnership with IntelliTect has sparked a culture of continuous improvement and set the stage for further innovation,” said Cliff Conklin, Director of Development, Washington Trust Bank.

Results: Delivering the Smart Application

The high-performance application was released on time. Critical features for optimizing the loan process were created to streamline day-to-day operations that will save time and money.

“I have found working with IntelliTect to be a positive experience,” said Jessica Steffensen, IT Business Analyst, Washington Trust Bank. “The team of developers is professional, knowledgeable, and responsive to requests from the product owners.”

The development team is continually improving the process, actively working towards componentizing the application in order to optimize future development and reduce maintenance costs.

About Washington Trust Bank

As the oldest and largest privately-held commercial bank in the Northwest, with more than 40 financial centers and offices in Washington, Idaho, and Oregon, Washington Trust Bank enjoys an advantage over its publicly-owned competitors. They base their decisions and policies on what’s happening right here in the Northwest—not in distant locales. Being independent, Washington Trust is able to set its sights on long-term goals rather than quarterly results. They stay focused on doing the right things for their clients and communities.

Does Your Organization Need a Similar Solution?

Let’s chat about how we can help you achieve excellence on your next project!